Botong is advantageous in its “financial analysis + mathematically modeling + macro strategy” capabilities. These three capabilities will assist one another. In daily investment and research work, modeling starts from people’s thinking and mathematics and procedures serve as the basis for demonstration and execution, to achieve highly cost-effective investment after correction. In other words, “proper control of risk-reward ratio at every time point sets seal on a long-term yield.”

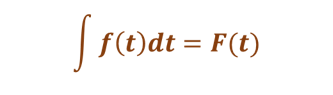

f(t):Risk/return ratioat any time

F(t):Rate of return for a period of time

The core of “half man and half horse” is that, men are better at thinking about future because men know what they want; while machines are cool and capable of transactions without optimistic hypothesis or greed, fear, or terror. In other words, “to have men do what they can do and horses do what they can do”.

The investment research team of Botong consists of the fundamentals group, momentum trading group, and macro group. More than 90% of the team members are post-graduates and above from Peking University, Tsinghua University, Zhejiang University, and other famous universities. They had been working in foreign and domestic mainstream institutional investors or large industrial enterprises for seven to more than ten years. They experienced the most important shift from bull market to bear market in the securities history in China and have achieved outstanding historic performance. They identify with and are adept at value investment, quantitative strategy, macro research, and other modern financial and investment theories.